Lifetime Value Protection and Savings

Document checks are a necessary step in protecting your business's front door, but how many leave the back door poorly defended? The chip in your passport validates your identity and proves you exist—leveraging this security feature can strengthen the identity lifecycle at critical moments such as account recovery.

Document Verification that pays for itself

Account recovery is an identity verification challenge. Most businesses pay contact centre staff to do an impossible job - ID verification over a phone call.

Huge costs in account recovery

Research indicates that over 30% of contact centre calls relate to account recovery. Recovery is often needed when users forget passwords, lose, break, or upgrade devices, as well as when restoring control after device theft or impersonation. Consequently, businesses incur significant costs for performing these difficult re-verifications and device-binding processes to protect from fraud and restore compromised accounts.

A bank vault front door with a fly-screen back door.

Account Takeover (ATO) fraud is pervasive and growing across various sectors, including banking, telecommunications, workforces and more, often exploiting a critical vulnerability: the inability of contact centre personnel to effectively verify identity.

The account recovery process is frequently handled by entry-level staff who conduct phone-based identity verification, an increasingly difficult task in an era of deepfakes, data breaches, and knowledge freely given away on social media.

While businesses have implemented measures to comply with Know Your Customer/Anti-Money Laundering (KYC/AML) regulations at the "front door", they have largely neglected the security of "back door" account recovery processes.

Chip away the costs

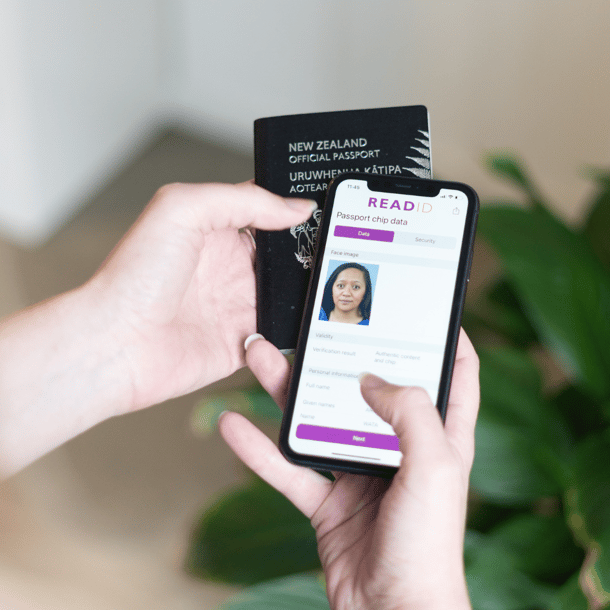

A potential solution already exists in the hands of billions of people: their passport, ID card or residence permit with an embedded NFC chip. A feature specified by international standards defined by the International Civil Aviation Organisation (ICAO), an agency of the United Nations.

Unlike the photo page of an ID card, this chip contains cryptographically verifiable proofs of the document’s data authenticity and includes a high-resolution facial image of the holder, without requiring access to a centralised copy. Many ID chips also include a private key that prevents copying and proves the original document is present in a verification session.

By enabling individuals to use their NFC-equipped phones to verify their chipped IDs at the moment of recovery and matching against stored data, businesses can replace inefficient contact centre interactions with automated self-service.

Deepfakes don’t have chips in their fake IDs

Importantly, deepfake-enabled attackers using voice and video cloning cannot mimic secure chips, as fraudulent IDs lack the cryptographic proofs issued only by official document producers authorised by their nation-state certificate authority.

The Easy Solution with NFC Chips

Unlike KYC/AML requirements, which necessitate background checks, it is possible to nudge individuals already known to an organisation to enrol their document chips. Users will benefit from enhanced protection of their accounts, which is both easier for them to regain access and significantly more challenging for attackers to compromise, allowing legitimate users to opt in and manage their own recovery access securely.

Using the cryptographic capabilities of document chips, organisations may only need to store a hash of the chip data to use it as a recovery authenticator, thus lowering the privacy and security risks of data storage. Users who don’t enrol their NFC IDs can still benefit from the safety net of a business-as-usual identity verification typically found in onboarding.

NFC document verification pays for itself in a way that optical verification can't

Adopting NFC chip-based identity verification for account recovery is proven to significantly improve efficiency, alleviate the burden on contact centre personnel, reduce ATO fraud and protect Customer Lifetime Value (LTV or CLV).

Bidbax Case Study

See how it works

Converting, scalable, easy-to-use, and secure NFC-based identity verification.

Subscribe for our Inverid Newsletter

ISO/IEC 27001 certified

ISO/IEC 27701 certified

eIDAS module certifications

SOC2 type 2

Cyber Essentials Plus