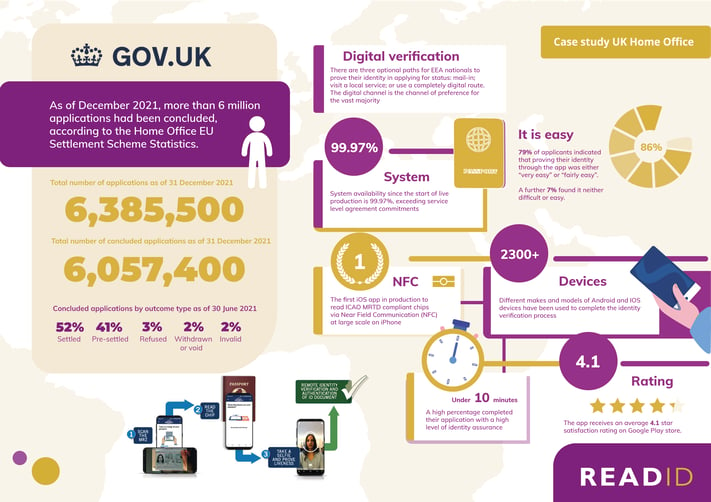

Uk home office

World’s Most Successful Remote Identity Verification Programme for Immigration

To support the United Kingdom’s exit from the European Union, the EU Settlement Scheme was established by the Home Office to allow EEA nationals living in the UK to apply for a UK immigration status.

How to reach a high onboarding conversion with NFC technology

Digital verification in 3 steps

Applicants need only to complete three steps:

- Prove their identity

- Show that they live in the UK

- Declare any criminal convictions

As the Home Office wanted to make the application process as easy as possible for the estimated four million EEA nationals who would need to apply, they sought out new innovative and effective capabilities to include in an optional end-to-end digital application channel. Together with our partner WorldReach Software (acquired by Entrust in 2021), we were selected to allow for a smooth application process.

WorldReach Software (now Entrust) is an organisation focused on highly trusted digital public services for immigration, passport, border management, consular and citizen service organisations.

WorldReach Software was selected by the Home Office for the operation and management of the digital verification capability supporting the EU Settlement Scheme (EUSS). Together with WorldReach and iProov, we managed to create the world’s largest, most successful digital onboarding immigration programme using remote identity verification.

"Using NFC we can remotely determine the authenticity of the identity document at the trust level that is needed for.”

ePassport NFC chip reading

This innovative service is powered by ReadID, which reads the ePassport chip’s security features to authenticate the legitimacy of the document, as part of WorldReach’s Know You Traveller platform. Also part of the identity verification is selfie matching. This is achieved by comparing the secure reference image from the ePassport chip to a live selfie captured by a smartphone camera. This service supports not only ePassports but also UK biometric residence cards and EU citizen eID cards, which all comply with ICAO standards.

Using NFC we can remotely determine the authenticity of the identity document at the trust level that is needed. In addition, the high-resolution face image from the chip enables secure facial matching. This use case clearly demonstrates why NFC based is the best approach in remote identity verification.

Identification take away

Download Case Study UK Home Office.jpeg?width=500&name=800px-Rt_Hon_Priti_Patel_MP_(28273511046).jpeg)

"Having more than 6 million applications to the scheme is an unprecedented achievement and I am delighted that we have secured the rights of so many EU citizens – our friends, neighbours and family members."

Priti Patel

UK Home Secretary

[Photo DFID]

Want to learn more about government-grade security for identity verification?

Contact a specialistResults

The EUSS is a very successful, scalable proof-point of what’s possible and achievable with the right end-to-end processes, technology and collaborative team.

- More than 6 million applications have successfully concluded (data from December 2021).

- A high percentage completed their application in under 10 minutes, with a high level of identity assurance.

- This was the first iOS app in production to read ICAO MRTD-compliant chips via NFC at a large scale.

- Over 2,300 different makes and models of Android and iOS devices have been used to complete the identity verification process.

- The service is scalable, with peaks of 25,000-30,000 applications per day as realized by the EUSS.

- System Availability since the start of live production is 99.97%, exceeding SLA commitments.

- 2019 EUSS feedback survey results: 79% of applicants indicated that proving their identity through the app was either “very easy” or “fairly easy”. A further 7% found it neither difficult nor easy.

Converting, scalable, easy-to-use, and secure NFC-based identity verification.

Subscribe for our Inverid Newsletter

ISO/IEC 27001 certified

ISO/IEC 27701 certified

eIDAS module certifications

SOC2 type 2

Cyber Essentials Plus