ASB

A high quality Customer

Journey for ASB

ASB was looking for a technology to rely on when onboarding customers from a distance. A seamless identification and user experience for their customers. With ReadID's NFC Technology, the number of customers who no longer need to visit a branch has increased fivefold.

We spoke to Andrea McKain, Delivery Lead Know Your Customer at ASB

Know Your Customer at ASB

ASB Bank was originally established in 1874 as the Auckland Savings Bank in New Zealand. It is a subsidiary of the Commonwealth Bank of Australia (CBA). ASB has a reputation for innovation and embracing new technologies, as it did with digital identity verification.

We discussed with Andrea McKain the reasons for working with ReadID and the results. She is the delivery lead for Know Your Customer at ASB and was responsible for the implementation of ReadID at ASB.

ASB already had a digital identity verification solution in place, launched in 2018. This solution was based on optical, OCR technology however ASB were disappointed with its conversion. The process was cumbersome and New Zealand money-laundering regulations meant that it required a secondary matching electronic confirmation as well. After scanning, customers also needed to manually check the data read before they could continue.

The process also led to many false negatives. In the end, many people still had to visit a branch office, something that was hard or even impossible during the COVID-19 pandemic. It was frequently not a seamless user experience. ASB needed a simpler solution to grow conversion and lower pressure on branch offices.

“It just wasn't a seamless user experience with OCR, leading to poor conversion” Andrea McKain, ASB

ASB ID app

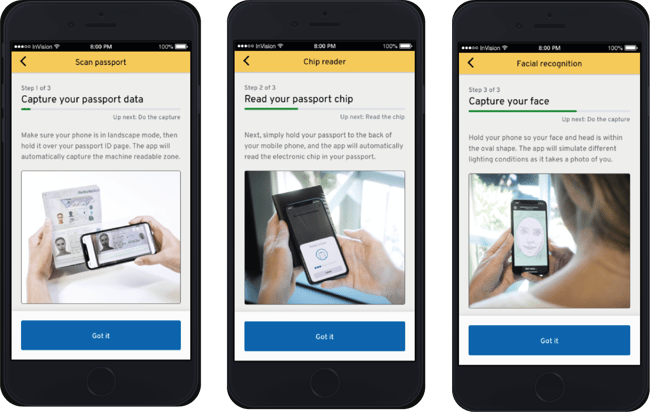

ASB became aware of the possibilities of NFC technology and Andrea quickly came across ReadID. ASB uses the ReadID SaaS SDK to integrate NFC as well as holder verification in their ASB ID app. A proof-of-concept phase convinced the team of the possibilities and in April 2021 ASB went live with its new solution.

This app has a big competitive advantage: ASB still is the only bank in Asia Pacific to use NFC technology! The app supports passports from over 130 countries, which is very important as New Zealand has a large population of immigrants. ASB is also looking into the possibility of re-introducing driving licenses to the customer journey, based on the capture of the photo page by ReadID.

“Customer feedback has been awesome, and the user experience is fantastic” Andrea McKain, ASB

Grow conversion with NFC

NFC has created a high-quality customer journey. Andrea states “Customer feedback has been awesome, and the user experience is fantastic.”

Conversion for customers who commence the passport read process in the ASB ID app has grown to over 89% (over 99% on iOS) and the number of customers who no longer need to visit a branch has increased fivefold.

The ASB ID app is primarily used for onboarding identity verification but is also used to verify the identity of existing customers where required.

Your key take away

Download Case Study ASBConverting, scalable, easy-to-use, and secure NFC-based identity verification.

Subscribe for our Inverid Newsletter

ISO/IEC 27001 certified

ISO/IEC 27701 certified

eIDAS module certifications

SOC2 type 2

Cyber Essentials Plus